We’ve all heard the old adage. “Whatever you do, don’t touch your retirement funds.” But what does that mean? Can’t all of the funds on your personal balance sheet be considered retirement funds?

Retirement planning is broadly defined as the process of determining retirement income goals and the actions and decisions necessary to achieve those goals. If you work diligently to grow your business with the goal of building wealth for your retirement, wouldn’t that be a prudent investment?

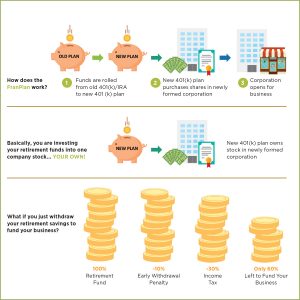

The primary difference between money in your 401(k) or IRA – and cash in your checking account, savings account, or securities portfolio – is that the money in a retirement account is pre-tax (unless it is a Roth IRA). Contrary to popular belief, you can access those pre-tax retirement funds to invest in your own business, without incurring any penalties.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry. This is to protect individuals who hold these plans. This act formed the basis of the program that the Internal Revenue Service refers to as ROBS, or Rollover For Business Start-Up.

In the simplest terms, ROBS allows an individual to buy stock in their own C corporation, using funds from a qualified 401(k) or IRA. At the conclusion of this transaction, the newly established 401(k), which is sponsored by the newly created C corporation, has shares of stock equal to the value of the investment. The corporation’s checking account has cash which may be used for any legitimate business expense.

Let’s examine an analogy. When you buy stock in a publicly traded corporation, such as Apple, you own those shares of stock. You hope that Apple is using that money to grow the value of those shares. If you’ve purchased shares within your own retirement account, the same principle applies, with the major difference being that you are in the driver’s seat. When you sell those shares, the original investment plus your returns will go back into your retirement account.

Taxes are paid when you ultimately take distributions from that account. The IRS allows penalty-free distributions after the age of 59 1/2 and requires mandatory distributions beginning at age 70 1/2. If you use a ROBS transaction to purchase your franchise, the same process applies.

ROBS is a serious business endeavor and is not a green light to use retirement funds to maintain a lifestyle, purchase a luxury car, or take a trip around the world; reckless purchases are probably responsible for the oft-repeated advice to not touch your retirement funds. However, taking advantage of your full, pre-tax retirement monies to invest in your own business is a great way to grow your portfolio.

Many successful franchises are fully funded by ROBS transactions, and many more are funded using retirement funds as equity injections for larger SBA loans. Using such tools can be both a responsible and lucrative investment, as well as a great way to grow your retirement funds.

– Sherri Seiber, Chief Operating Officer for FranFund

FranFund: FranFund designs flexible funding plans that help new and experience business owners fund their franchises. We have a powerful and accurate pre-approval process. Our former bankers analyze a candidate’s financial situation the same way a lender would, and we have a 99% success rate in obtaining loans for borrowers who received FranFund pre-approval! We offer ongoing support and make sure our clients know all of their options for funding single units through multi-unit expansions including SBA loans, conventional lending, and retirement plan funding with a risk-free SafetyNet® option. For more information, contact Sherri Seiber: sseiber@franfund.com