Starting a new business or expanding an existing one can be very exciting, but most things that big rarely happen without a little help and a little capital. Whether you’re planning to start a business or want to expand an existing one, securing funding is one of the most important parts of the process.

There are four main types of funding: Equity funding | Debt funding | Asset-backed funding | Self-funding

The two most popular business funding methods are self-funding with a Rollover for Business Startup (ROBS) and Small Business Administration (SBA) loans.

Rollover for Business Startup (ROBS)

You can capitalize your business with your own money through a ROBS funding plan. It allows aspiring business owners to roll their 401(k)s over into investment capital.

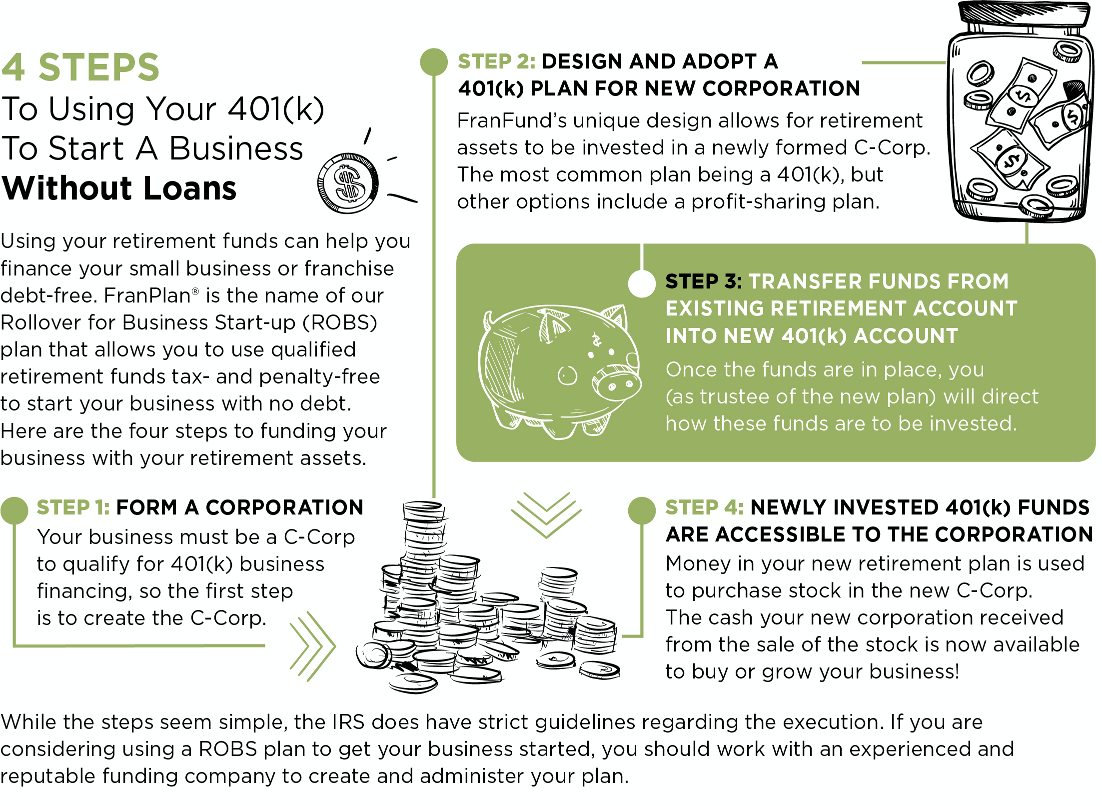

FranFund has streamlined the ROBS process with these four easy steps.

4 STEPS To Using Your 401(k) To Start A Business Without Loans

Using your retirement funds can help you finance your small business or franchise debt-free. FranPlan® is the name of our Rollover for Business Start-up (ROBS) plan that allows you to use qualified retirement funds tax- and penalty-free to start your business with no debt. Here are the four steps to funding your business with your retirement assets.

In as little as 10 business days, you can access funds to use for any legitimate business expense, including your own salary.

Small Business Administration (SBA) Loans

SBA loans are also a popular method of funding. Even though many banks offer SBA loans, they can still be selective about the types of industries they work with and the number of startups they lend to. Since FranFund has established an extensive network of lenders who are franchise friendly, we can match you up with the right lender.

You may decide to use a combination of a ROBS plan and an SBA loan

Many clients who don’t have the cash required for a loan use a ROBS plan to access the funds needed for the equity injection. This is also a good strategy if you plan on opening additional units, so you have a reserve of available funds for future expansion.

To help you determine the best funding solution, the FranFund funding experts offer a no-pressure consultation to evaluate your financial situation and make recommendations about the best strategy for you. Our approach is very effective, and we were recently voted #1 Funding Provider in Entrepreneur Magazine’s Annual Franchise Industry Supplier ranking. If you’re ready to get started, visit franfund.com.

Sherri Seiber is the Chief Operating Officer for FranFund. She and her team are passionate about designing flexible funding plans that help new and experienced business owners fund their franchises, from single units through multi-unit expansions. For more information, contact Sherri at sseiber@franfund.com or visit franfund.com.

– Sherri Seiber, Chief Operating Officer for FranFund

FranFund: FranFund designs flexible funding plans that help new and experience business owners fund their franchises. We have a powerful and accurate pre-approval process. Our former bankers analyze a candidate’s financial situation the same way a lender would, and we have a 99% success rate in obtaining loans for borrowers who received FranFund pre-approval! We offer ongoing support and make sure our clients know all of their options for funding single units through multi-unit expansions including SBA loans, conventional lending, and retirement plan funding with a risk-free SafetyNet® option. For more information, contact Sherri Seiber: sseiber@franfund.com